R&D tax credits are a part of the business world that seem to be shrouded in some mystery. People have heard the name in passing, but don’t really know what it is all about. Like many elements of the unknown, we don’t find out enough about them and think it will still be there when we have the proper time to take a closer look. There may be missed opportunities if you don’t act promptly with R&D tax credits. Here are the top 6 question you should be asking about R&D tax credits and what they mean to you –

1 - What are R&D tax credits?

This is a great place to start. The government wants to stimulate investment in new technologies, improved processes and better products. This will make the UK more competitive and drive productivity. The scheme started some time ago, but has seen a renewed impetus with Brexit and a change in the economic climate that this may bring.

R&D tax credits are there to reward businesses that take a commercial risk in order to develop new products, new processes or improve the ones they already have. This incentive comes in the form of a rebate on the next tax bill or cash straight into the bank account of UK businesses.

2 – Who can claim them?

Let’s get straight to the most important part. We suspect that if you are reading this article, you want to know if this applies to you. Although it is nice to keep up with the latest trends in business, the bottom line is often the cold hard cash element.

R&D tax credits can be claimed by businesses from many different parts of the economy. They work for business as far and wide as manufacturing to food and drink; from technology to the pub game. The image of Research and Development is one of high tech and a big budget. Don’t get caught in that way of thinking because you may miss out on a large claim for your business.

3 – What counts as an R&D project?

This is another great question. R&D is viewed by the government under certain criteria for the purposes of assessing and paying an R&D claim. This is administered by the HMRC, so, as you would expect, there is a set formula for submitting a claim. In short, they state that a project must –

- Look for an advance in science and technology

- Had uncertainty to overcome

- Attempted to achieve this

- Could not be easily worked out by a professional

If this sounds like an onerous set of criteria, then don’t worry. We have the expertise to see an R&D tax claim in your business that might not be obvious to you. Get in touch with us today and we will help you here.

4 – What kind of costs can I include in a claim?

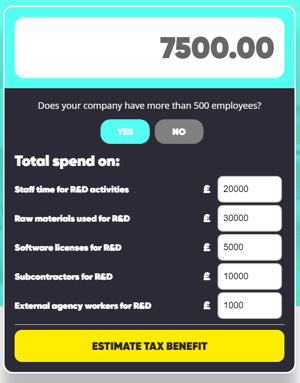

Once you have a good idea of whether you have a claim, and don’t forget that we are here to help with this, then it is time to pull the figures together. But you need to know what figures are part of a valid claim. Many of the processes of the tax man look unnecessarily complicated from the outside. But don’t worry, we are here to guide you through this.

There are some simple costs that you should make sure are included in your claim, such as –

- Salaries of your team

- Associated staff costs such as pension and employers NI contributions

- Any freelancers or subcontractors you have used

- Any materials used

Each claim will be slightly different, so make sure you have assessed all the relevant costs.

5 – How long will it all take?

Dealing with the HMRC can conjure up images of waiting for hours on the phone and weeks to receive the first response. But with R&D tax claims, the process is surprisingly quick. If all of the information is gathered and submitted correctly then you could see the money back in your business within 6 weeks. Yes, it’s that quick!

And all of the processing with the tax man needn’t get you down. We will take care of the whole thing for you. We work on a no win, no fee basis so you don’t pay anything up front. Let us take the strain for you.

6 – How do I get started with my R&D tax claim?

We’re glad you asked! Drop us a line and we will assess your eligibility for a claim. It only takes around half an hour of your time and from there, we can get you started on the road to R&D tax claim success.